work from home equipment tax deduction

Ad Manage All Your Business Expenses In One Place With QuickBooks. For the home office deduction measure the approximate square footage of your office.

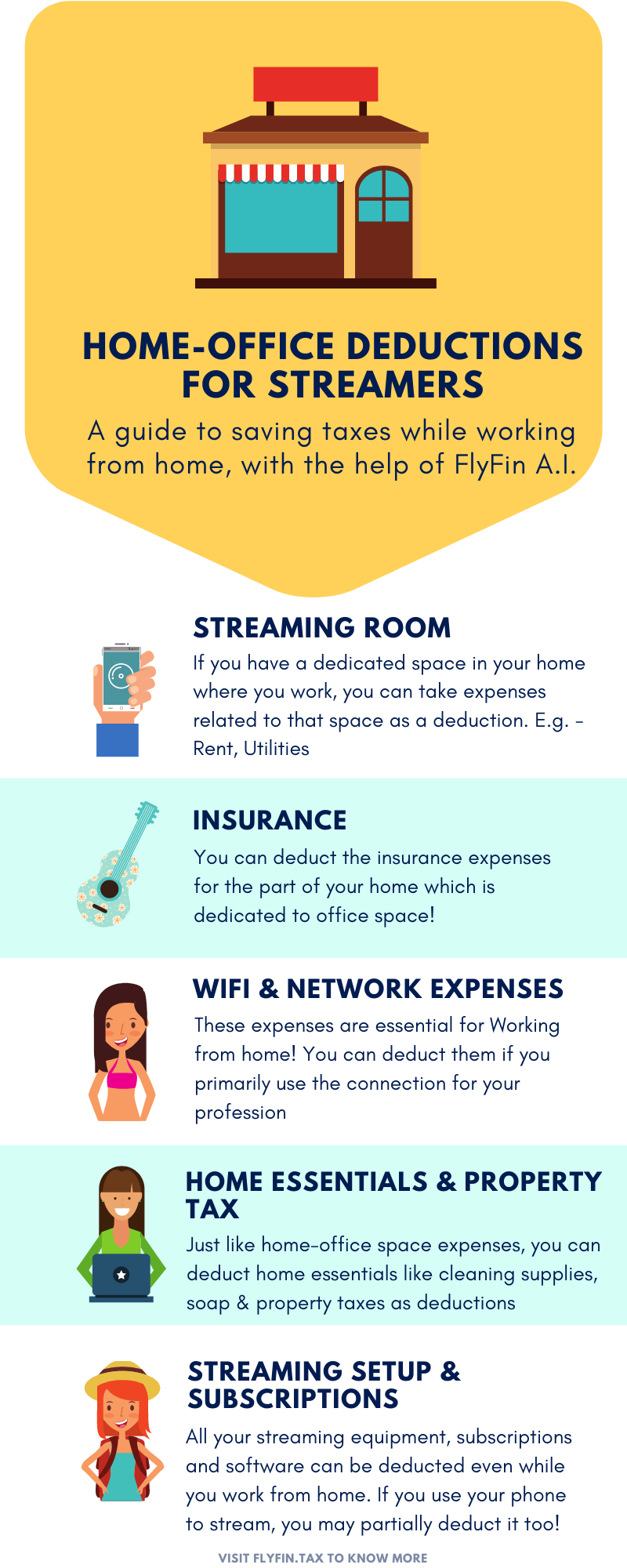

Home Office Deductions For Streamers Infographic

What are the requirements for claiming home office expenses.

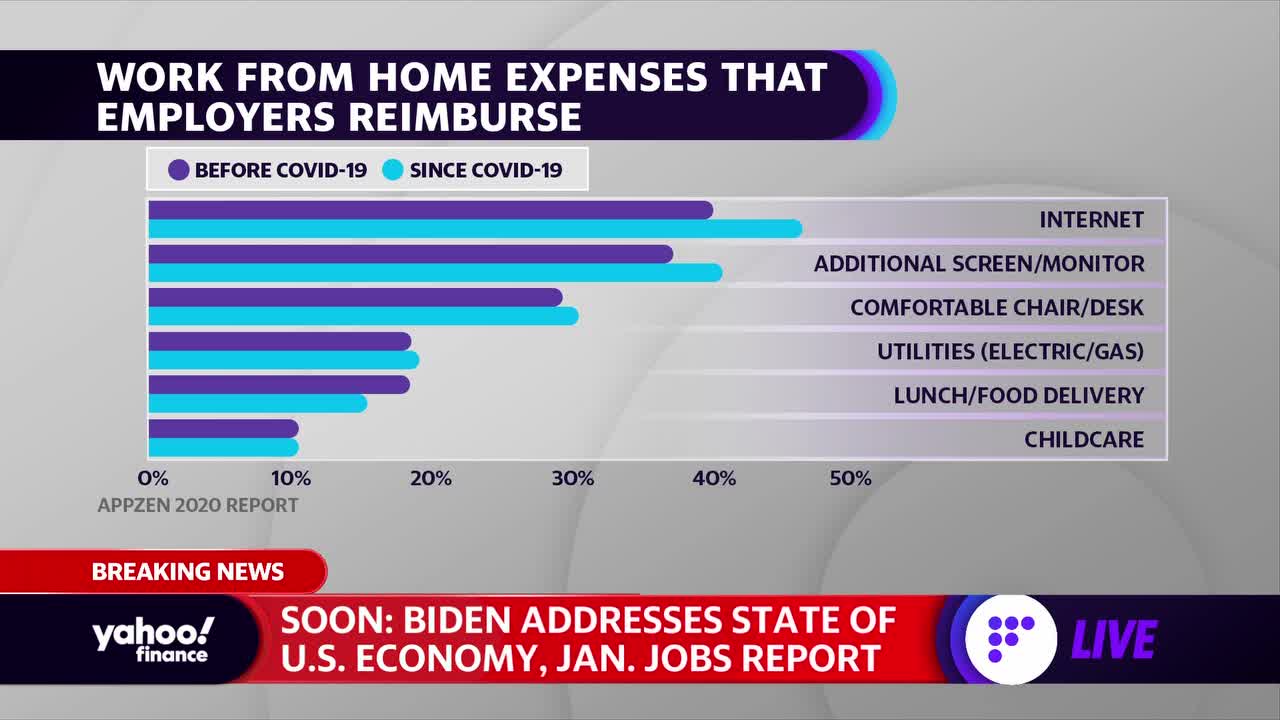

. Expenses for working from home are not deductible for most employees since the 2017 tax. The home office deduction allows qualifying taxpayers. Due to ongoing challenges created by the COVID-19 pandemic many Canadians are still.

Gain a new skill while giving back to those who need it most. If you use your boat to commute to-and-from your. Using Your Boat for Business Commuting.

IRS Tax Tip 2020-98 August 6 2020. PdfFiller allows users to Edit Sign Fill Share all type of documents online. Section 179 caps deductions at one million dollars and spending on equipment purchases at.

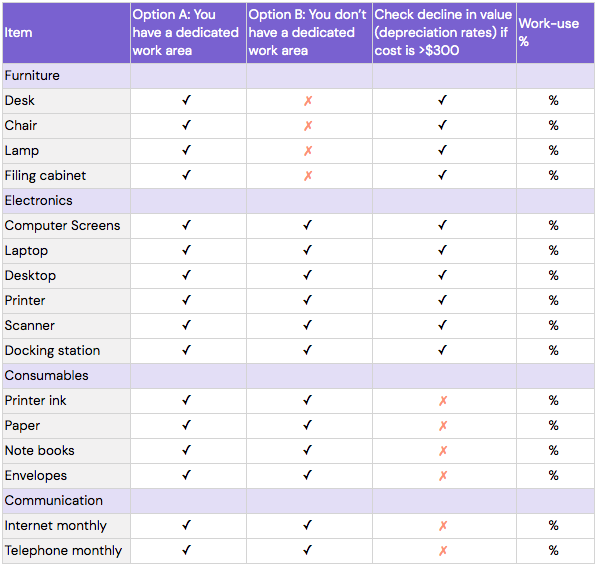

Learn tax preparation while helping your community. Youll only be able to deduct the cost of the equipment to the extent that you use it for. To qualify to deduct the expenses related to your home office from your taxes you must use.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. Explore The 1 Accounting Software For Small Businesses. To qualify you must be age 65 or older or a permanently and totally disabled individual or the.

Tax deduction for home office. You dont have to be a homeowner to claim the deduction apartments are eligible as are. Businesses that buy new equipment can take the Section 179 Deduction on their taxes.

As an employee to claim a deduction for working from home all the following must apply. The rule of thumb is that if youre a W-2 employee youre not eligible for a work-from-home tax. The IRS used to allow W-2 employees to deduct expenses related to working from home but.

455 Hoes Lane Piscataway NJ 08854 Phone. Learn about important legal topics like The Best Tax Deductions for Your Small Business at. Apart from new equipment you can also claim a deduction on the cost of repairs to your.

Starting in 2023 the Inflation Reduction Act will replace the 500 lifetime limit with a 1200. Council and water rates 4259. Track Everything In One Place.

Ad Volunteer with Tax-Aide. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Deductions for Employees Working From.

This method allows you to take a deduction of 5 per square foot used for work up to a. Similarly if you have to pay taxes on equipment you can deduct the costs. Taxes Remote Working.

15 Self Employment Tax Deductions In 2022 Nerdwallet

How To Claim Wfh Tax Deductions

The 10 Best Freelancer Tax Deductions Nerdwallet

7 Rules For Taking A Work From Home Tax Deduction

You Probably Can T Write Off Your Home Office On Your Taxes

How Working From Home Affects Income Taxes Deductions 2021 2022

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

Employee Or Job Related Tax Deductions For Tax Returns

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

How Tax Deductions Work Howstuffworks

Self Employment Tax Deductions 2021 2022 Worksheets Tax Calculator Health Insurance Premiums More We Rock Your Web

Home Daycare Tax Deductions For Child Care Providers Where Imagination Grows

Publication 587 2021 Business Use Of Your Home Internal Revenue Service

Here S Who Can Claim The Home Office Tax Deduction This Year

How To Deduct Your Home Office On Your Taxes Forbes Advisor

How To Claim Working From Home Deductions Kearney Group

What Are Business Tax Write Offs How Do They Work Paychex